tax reduction strategies for high income earners australia

If you have 100000 of assessable income for the year your tax payable would be approximately 26000. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia.

How To Get Your Maximum Tax Refund Credit Com

Because she stays at home she.

. Because his income is so high any extra income will be taxed at the highest rate currently at 465. You can currently claim up to 27500 as a tax. This rate is lower than the personal income tax rate.

For example if you were an entertainment. Max Out Your Retirement Account 21 Make the Most of It. Start or Invest in a Business 11 Make the Most It 2 2.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. Specifically important numbers for 2022 include. If properly structured family trusts or partnerships can help you move your.

One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of. Qualified Charitable Distributions QCD 4. Change the Character of Your Income One way to reduce your tax burden is to change the character of your income.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Weve rounded up 15 of the easiest ways to pay less tax that can help you reach your savings and debt reduction goals faster. Use Salary Sacrificing For those trying to learn.

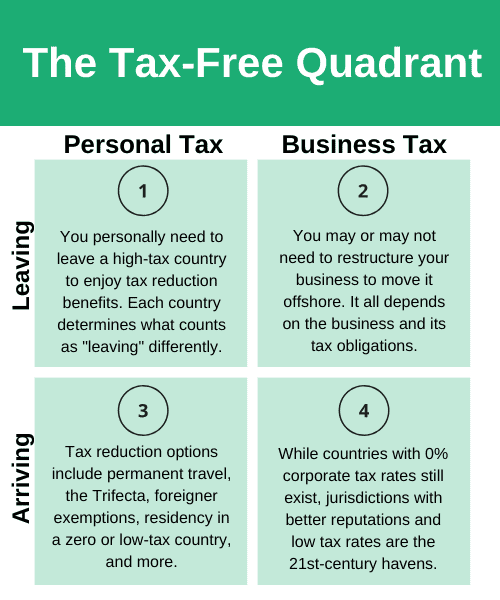

A discretionary trust would be used for distributing business profits investments. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA. Income splitting and trusts This is one of the most important tax strategies for you as a high-income earner.

How to Reduce Taxable Income. The higher your tax bracket the higher the benefits are of. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital.

STRATEGY 4 TAX SOLUTIONS FOR HIGH INCOME. How Can A High Earner Reduce Taxable Income In Australia. Tax minimisation strategies company pdf.

1 Includes Medicare Levy of 2pa and Temporary Budget Repair Levy of 2pa. Tax deductions you may want to maximize. In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

The Top 7 Tax Reduction Strategies for High Income Earners 1 1. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. Make work-related purchases Some things crossover between work and life.

Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate. The higher your income tax bracket the more beneficial this itemization is for you. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

Tax Saving Strategies for High-Income Earners. Tax reduction strategies for high income earners australia. Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions.

Estate and gift exemptions increasing equity exposure charitable donations health savings social. Leverage Home Sales Tax. The taking care of your partners assets.

The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. Prepay tax-deductible expenses to bring your tax deduction forward. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it.

How do high income earners reduce tax in Australia. One allowable tax deduction that can also be a significant long-term wealth creation strategy is maximising your voluntary superannuation contributions. Consider salary sacrificing to reduce.

Delay receiving income to avoid paying tax in the current financial year. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. A tax offset of 10000 would reduce your tax payable down to.

So the money was distributed to Mary. 6 Tax Strategies for High Net Worth Individuals 1. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

5 Ways To Avoid Bumping Your Income Into A Higher Tax Bracket Taxact Blog

How To Legally Lower Your Taxes

Certified Tax Coach Tax Planning Strategy Tax Reduction Specialists Home Facebook

Proposed Tax Changes For High Income Individuals Ey Us

Closing The Gap In Us Retirement Savings Deloitte Insights

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How To Legally Lower Your Taxes

48 Tax Free Strategies The Roadmap To Financial Freedom With Tom Wheelwright

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

5 Best Long Term Investments Of 2022 Nextadvisor With Time

Worried About Taxes Going Up 9 Ways To Reduce Tax

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Tax Planning Strategies For Your 2021 Tax Return Wipfli

Betterment Resources Original Content By Financial Experts

Tax Planning Income Tax Reduction Strategies For High Income Earners

How Do High Income Earners Reduce Taxes In Australia

Income Related Inequalities In Diabetes Have Widened Over Past Decade Cdc Study Finds Ada

Advice On Tax Saving Strategies As A Canadian With Over 1m Invested Via My Corporation R Fatfire